#CBSE Together with CBSE sample papers

Explore tagged Tumblr posts

Text

Common Mistakes to Avoid During Class 12 Exam Preparation

CBSE Class 12 examinations are the pinnacle of school-level examinations. There is a lot of hype around class 12 exams which indirectly makes it more difficult for the students. Every student has a strategy to maximize their class 12 score. However, sometimes students unknowingly commit mistakes that reduce their chances of walking down the path of glory.

#CBSE class 12 exams#CBSE Class 12 exam preparation#During Class 12 Exam Preparation#Together With CBSE Sample Paper#CBSE Together with CBSE sample papers

0 notes

Text

How to Prepare for the CBSE Board Exams in 2025

This is an important announcement for all Class 10th and 12th students preparing for the upcoming CBSE Board Examinations Date 2025. The Central Board of Secondary Education has officially released sample papers tailored to help you excel in your exams. These are not just papers—they’re your roadmap to understanding the exact structure, format, and type of questions that you’ll face on the big day.

What’s even better? These CBSE sample papers are now available on the Sarthaks, a trusted hub for student resources. Here’s why these sample papers are a must-have for your preparation:

Insightful Preparation: The sample papers give you an insider’s perspective into the question patterns, marking schemes, and exam formats, giving you an edge over others.

Boost Confidence: Practice with these papers to simulate the real exam experience and build your confidence to face the toughest questions with ease.

Comprehensive Resources: Along with sample papers for Class 10th and 12th, Sarthaks eConnect provides a treasure trove of additional materials to elevate your preparation.

Why Choose Sarthaks eConnect? At Sarthaks, we believe in empowering students like you with top-notch resources to unlock your full academic potential. When you visit Sarthaks.com, you’ll find:

Class 10th CBSE sample papers with solutions to make revision effortless.

Class 12th CBSE sample papers tailored for every stream, ensuring no topic is left untouched.

Easy access to free study materials, including NCERT solutions, notes, and much more.

Don’t Wait—Start Preparing Now! Every second counts when it comes to your board exams. By practicing with these CBSE sample papers, you are not just preparing for an exam—you are preparing for your future. With the right strategy, consistent practice, and dedication, success is within your reach.

Take Action Today! Visit Sarthaks now, search for Class 10th CBSE sample papers and Class 12th CBSE sample papers, and kickstart your journey toward excellence. This is a golden opportunity to sharpen your skills and enter the examination hall with confidence and determination.

Remember, this is your moment to shine! Success favors those who prepare diligently. Grab these resources, give your best, and let these sample papers be the key to unlocking your success story.

Quizard is the ultimate destination for creating and playing quizzes, making it the best quiz maker site available. With a vast range of categories, from academics to general interest topics, it ensures there’s always something new to explore. The platform offers Online Quiz Games to Play with Friends, letting you compete, challenge, and learn together, turning knowledge into a fun social experience. Whether you're testing your skills or simply having fun, Quizard’s intuitive interface and countless quiz options make it the go-to platform for interactive learning and entertainment.

Best of luck for your exams—your bright future awaits!

0 notes

Text

Best NEET Online Coaching in India for NEET Prep 2024

Unlock Your Potential: Embrace Success with the Premier NEET Online Coaching in India – Sarvanga!

Are you ready to ignite your journey toward becoming a distinguished medical professional? Look no further! Sarvanga proudly stands as the beacon of excellence, offering the finest NEET online coaching in India tailored to elevate your aspirations for NEET 2024.

visit us - https://sarvanga.in/online-classes-for-cbse-jee-neet

Why Sarvanga?

1. Expertise Beyond Compare: Our esteemed faculty comprises accomplished medical practitioners, revered educators, and subject matter maestros, each committed to sculpting your path to success. With their guidance, you'll unravel the intricacies of the NEET syllabus, empowering you with the acumen to conquer every challenge.

2. Technological Prowess: Experience a seamless blend of innovation and education with Sarvanga's state-of-the-art online platform. Immerse yourself in interactive live sessions, delve into enriching video lectures, and explore dynamic study materials – all designed to amplify your understanding and retention.

3. Tailored Excellence: Recognizing your individuality, we embrace a personalized approach to learning. Through comprehensive assessments and meticulous tracking, we tailor our strategies to cater to your unique learning style, ensuring every step of your journey is purposeful and effective.

4. Holistic Preparation: Our holistic curriculum spans Biology, Physics, and Chemistry, meticulously curated to align with the latest NEET syllabus and exam patterns. Engage in mock tests, practice sessions, and sample papers – each meticulously crafted to fortify your exam-taking prowess.

5. Thriving Community: At Sarvanga, you're not just a student; you're a valued member of a dynamic learning community. Collaborate with peers, share insights, and draw inspiration from fellow aspirants – together, we'll propel each other toward excellence.

Seize Your Future Today!

Don't allow uncertainty to hinder your dreams. Take the leap toward a vibrant medical career by enrolling in Sarvanga's NEET online coaching today. With our unparalleled faculty, cutting-edge technology, personalized approach, and supportive community, your success in NEET 2024 is not just a possibility – it's a certainty. Embrace the journey with Sarvanga, where every aspiration finds its wings. Visit our website now to embark on your transformative voyage!

1 note

·

View note

Text

A Guide to the Best Reference Books

Embarking on the journey through CBSE Class 10th can be a challenging yet rewarding experience. A crucial element in ensuring success is the choice of the right reference books. In this blog, we will explore the top picks that promise to be your trusted companions on the road to academic excellence.

NCERT Textbooks: The Foundation of Knowledge The NCERT textbooks stand as the bedrock of CBSE education. For Mathematics, Science, Social Science, and English, these books offer comprehensive coverage and are an essential starting point for building a strong foundation.

2. RD Sharma: Mastering Mathematics Mathematics often poses a significant challenge, but "RD Sharma" acts as a beacon of clarity. With detailed explanations and ample practice problems, it guides students through the intricacies of the subject.

3. Together with Science: A Comprehensive Companion Science enthusiasts will find solace in the "Together with Science" series. With a focus on conceptual clarity and practical application, this resource aids in mastering the intricate world of Physics, Chemistry, and Biology.

4. Social Science - Evergreen and Laxmi Publications "Evergreen Social Science" and "Social Science Class X" by Laxmi Publications are go-to choices for delving into history, geography, civics, and economics. These books provide a holistic view, aiding students in understanding complex societal dynamics.

5. Golden English Communicative: Language Mastery English Language and Literature are not just subjects; they are skills to be honed. "Golden English Communicative" and "Main Course Book" by NCERT are excellent resources, offering language proficiency and literary insights.

6. Exam-Oriented Guides: Arihant and Oswaal For those seeking focused exam preparation, guides from Arihant and Oswaal Publications are invaluable. These publications streamline information, provide sample papers, and offer quick revision notes for last-minute preparations.

7. Subject-Specific Guides: Excel Books and Pradeep’s Science Excel Books for Mathematics and Pradeep’s Science series for Physics, Chemistry, and Biology are renowned for their detailed content and extensive question banks. These guides cater to the specific needs of students aiming for perfection in these subjects.

As you gear up for CBSE Class 10th, selecting the right reference books is akin to choosing reliable companions for a challenging expedition. These recommended resources encompass a spectrum of subjects, providing clarity, practice, and exam-centric focus. Remember, success is not just about hard work but also about strategic and informed study choices. So, equip yourself with these trusted guides, navigate the academic landscape with confidence, and set sail towards success in your CBSE Class 10th examinations.

1 note

·

View note

Text

Quick Tips For Students Appearing In CBSE Boards 2023

Your Bigger Goals need to be pushed by the smaller objectives you decide for yourself, and the making of each objective should be followed by proper planning to it. The key to your study goals is not different. Here also you’ll have to plan vividly, before you dream of being inside your dream institution.

For CBSE students, the planning is even easier as CBSE has been releasing a marking scheme for students to decide the amount of attention they should pay to a particular topic. Added to that, CBSE issues the latest sample papers for students to be prepared with the type of questions they will get from each category. Not just that, the level of questions can be seen in the sample papers.

Marking scheme and question levels, together help you make the planning and time division. If you’re short of time, you can also take the help of sample papers to judge which topic can be skipped. The topics of great importance can be picked over the other ones.

CBSE sample papers are now available at cheap rates. MBD books is one such publisher who has recently launched a book comprising sample papers. It’s popular amongst students as MBD Rocket Sample papers. The solved solution to sample papers gives an insight into the best answer tricks that you can learn and re-learn to be able to use them. What makes those answers significant is the fact that the techniques used are time-saving. You will have considerable time to spend on other questions if you will use the time wisely.

The book also has a collection of chapter-wise important questions that helps you in last-minute reading as well. Questions are as per CBSE guidelines and have reached you after being filtered multiple times by the academicians. The questions are provided readily available for you to overview, skim, and make an analysis, as your time allows.

One another feature of the MBD Rocket sample paper books is the 5+ unsolved CBSE sample paper in it. Unsolved sample papers give a gush of a challenge to you, and these are the challenges that not only excite you, but they are also shaping you. The competitive spirit in you will be always trying to better your performance against the previous sample paper you solved. So it’s a 4-time opportunity to fight from your previous performance. Only when you better yourself, do you become the best among the rest.

This one book is your exam planner. Class 10 and 12 students must not miss the opportunity to be immune to the difficulty levels of board exams.

As the dates for CBSE Board Exams are near, students are in dire need of some quick tips that can help them achieve their desired grades. We understand that every student has a unique way of studying. Some of us study the subjects in rotation, and other study continuously the same subject for days. Some students are better to study in isolation, while some need the presence of a tutor.

Despite all the variations in the pattern of a student, some quick tips have helped most students to perform better. These tips are better recommended for students who are at the last phase of their preparation.

It is often emphasized to practice questions from multiple sources as it tells whether it’s the concept that is clear or the answers learned. The quick tips to get hold of your performance goes as:

Prioritize : High Weightage chapters should be given priority. CBSE marking scheme tells you the updated weightage given to the chapters. Check the marking scheme and make a priority list of the chapters you will revise first.

Questions : Go for the different question types. Do not stick to one subjective or objective type; rather aim at having a pool of questions that hits the same concept differently. This would be your way to check how much of the concept you hold.

Do the Questions : Some students often read the questions in the book, and think that they’d be able to do them, which is why they don’t use the pen to solve. Doing the answers on paper contributes to speed, speed being the key to excelling in exams. Even after you have the answer tricks in mind, without speed, you won’t be able to produce them in answer sheets. At least, 2-3 CBSE sample papers should be solved thoroughly by you, before you appear for your actual board exam. Replicate the exam-time scenario as it is, to judge your performance.

MBD Rocket CBSE Sample papers would be your perfect companion to follow these quick tips. Class 10 and 12 students can cheaply order their sample paper books online or buy them at the store.

The highlights of the sample paper books are:

Latest Sample Question Paper was issued by CBSE on 16th September 2022, with Marking Scheme

All types of questions:

Both Objective and Subjective types; MCQs, Very Short, Short, Long Answer

Assertion and Reason: Statement Based questions

Case-Based/ Situation Based/ Source Based/Picture-Based Questions

5 Unsolved Sample Papers For Practice

0 notes

Text

online classes for class 10th chemistry

I-view academy Chemistry Session is designed exactly to help you in your Chemistry Preparation. I-view academy Learning with NCERT guide/solutions, Notes, videos, online study material together with sample question papers based on ICSE/CBSE and Observe Experiment and Learn.

visit us -

youtube

0 notes

Text

How do MCQ questions benefit the class 9th students?

Clearing 9th class exams with flying colours when you have correct MCQ questions with answers

One of the most significant issues for students in qualifying for 9th class exams is how to crack the MCQ and get good marks. It is for this reason that not only passing this test is necessary, but also passing this examination with an exceptional rank in order to make a difference is crucial.

It's critical to demonstrate that earning a good grade is only feasible if pupils plan beforehand. Every student studies really hard in order to be eligible for this exam. However, if the student works really well, the odds of obtaining a rank improve. This is your time to study and make a way for your career. Clearing the multiple-choice questions is one of the most crucial tasks and thus needs to be paid full focus on.

How do MCQ questions benefit the class 9th students?

Based on the primary ideas and themes presented in the textbook as per CBSE new test pattern, MCQ Questions for Class 9 Science with Answers PDF Free Download is accessible here. This will assist you in learning and testing your comprehension of the chapters.

Students may also take a free exam of online test for class 9 and class 9 Science MCQ. Each question includes four possibilities, each of which is followed by the correct response. These MCQ Questions were chosen in accordance with the most recent CBSE exam format.

Why is there a need to look for MCQ questions for class 9?

Science in 9th grade has played an important part in students' academic careers. It is the ideal moment to tailor their study habits to the approaching school exams. To aid students' preparation, the Entrancei team has created MCQ Questions for Class 9 Science with Answers and worksheet for class 9. We believe in getting students ready for their forthcoming exams.

A preliminary practice might help pupils gain confidence. Students at Entrancei must adopt a comprehensive approach to test preparation. Reinforcing your preparation with MCQ questions and NCERT solutions for class 9 in the days leading up to exams will be beneficial. Your degree of preparation can also be determined by how well you attempt and solve problems.

Why are MCQ Questions with Answers for Class 9 Science Important?

Students may recognize themselves with prominence to their tests by using CBSE sample papers for class 9 maths and MCQ questions with answers for class 9 science. The staff at Entrancei’s only goal is to instil confidence in pupils so that they can answer as many questions as possible.

The format of the CBSE important questions for class 9 is consistent with the requirements of final examinations. It helps pupils to understand concepts more clearly. If you're studying for school-level or national-level exams, it's critical to get in as many practice sessions as possible. Class 9 is an excellent benchmark for solidifying one's preparedness for competitive tests at the national level. At Entrancei, we prepare students for a variety of competitive exams.

We are well aware of how extensive the entire syllabus for class 9th science is. We have made every attempt to eliminate any unneeded items in order to save time. To achieve top grades, a comprehensive study of MCQ Questions for Class 9 Science with Answers supplied by Entrancei is sufficient. The entire set was put together in a very short amount of time.

Students are given a thorough summary to ensure that they do not miss any topics. While completing MCQ Questions for class 9 Science with Answers supplied by us, students may get all of their ideas clarified.

How to Study Class 9 Science MCQ Questions and Answers Effectively

The Entrancei faculty has put in a lot of work to create a topic-specific, comprehensive, yet compact study material for pupils. The questions in the subjects have come from the syllabus's most essential themes. Students who fully prepare for this topic will very certainly see similar questions in their final exams.

The entire layout was created by seasoned educators with years of expertise. All of the major subjects are covered in the whole collection. Students can improve their understanding of concepts by using a holistic approach to solving MCQ Questions for Class 9 Science with Answers. This package of study materials is ideal for resolving difficult situations.

#ncert#ncert textbooks#ncert syllabus#ncertnotes#ncert solutions#ncert gender-neutral training#ncert to assess children#ncertclass9#ncertquestion#ncertstudents#class 9th#class9student#ncert9classscience

0 notes

Text

Master the Class 10 English Communicative Paper with ‘Together with’ (EAD) CBSE Sample Papers

CBSE English Communicative Paper 2025 evaluates your understanding of the Reading, Writing, Grammar, and Literature sections. CBSE tests your knowledge about these sections in the board exam. You have to solve questions from each section and write their correct answers within the given time limit. Each section of the Class 10 English Communicative paper requires unique planning and approach to write the answers correctly.

#Class 10 English Communicative paper#CBSE English Communicative Paper 2025#Together with’ (EAD) CBSE Sample Papers

0 notes

Link

Buy Now: https://bit.ly/3w4kFrc

#CBSE Sample Papers Term 1#term 1 mcq sample paper#cbse sample paper class 10#Social Science sample paper class 10#Term 1 Social Science sample paper

0 notes

Text

Buy Solomon’s Organic Chemistry Book Online

Organic chemistry is the study of the design, properties, organization, responses, and arrangement of carbon-containing compounds. Most natural mixtures contain carbon and hydrogen, however they may likewise incorporate quite a few different components (e.g., nitrogen, oxygen, incandescent lamp, phosphorus, silicon, sulfur). Initially restricted to the investigation of mixtures delivered by living organic entities, Organic chemistry has been widened to incorporate human-made substances (e.g., plastics).Organic chemistry is a profoundly imaginative science that permits physicists to make and investigate particles and mixtures. Natural scientists invest quite a bit of their energy growing new mixtures and discovering better methods of incorporating existing ones.Organic mixtures are surrounding us. Numerous cutting edge materials are essentially somewhat made out of natural mixtures. They're vital to monetary development, and are central to the fields of natural chemistry, biotechnology, and medication. Instances of where you can discover natural mixtures incorporate agrichemicals, coatings, beautifying agents, cleanser, dyestuff, food, fuel, petrochemicals, drugs, plastics, and rubber.Most purchaser items we use include Organic chemistry. Accept the beautifiers business for instance. Organic chemistry looks at how the skin reacts to metabolic and ecological variables, and scientific experts detail items as needs be. Different instances of ordinary items that include Organic chemistry incorporate cleansers, plastic products, scent, coal, and food added substances. Significant to current world economies, natural mechanical science centers around changing over crude materials (e.g., oil, petroleum gas, air, water, metals, and minerals) into shopper and modern items. Today, natural modern science depends chiefly on oil and petroleum gas. Since these are limited crude materials, a great deal of industry center is around figuring out how to change over inexhaustible assets (e.g., plants) into modern natural synthetics.

In Organic chemistry, the attention is on the component carbon. Carbon is key to all living beings; be that as it may, a huge number of nonliving things (like medications, plastics, and colors) are produced using carbon compounds. Jewels are carbon molecules in a precious stone construction. Precious stones are so difficult on the grounds that the iotas of carbon are so firmly reinforced together in the gem structure. That equivalent capacity to pack intently together makes carbon a brilliant primary component in its different structures also. One iota of carbon can join with up to four different iotas. Consequently, natural mixtures normally are huge and can have a few particles and atoms fortified together. Natural particles can be huge, and they involve the primary segments of living life forms: sugars, proteins, nucleic acids, and lipids. In Organic chemistry, atoms that have comparative properties (regardless of whether they are synthetic or actual properties) are assembled together. The explanation they have comparable properties is on the grounds that they have comparative gatherings of molecules; these gatherings of iotas are called practical gatherings. Compound properties include one substance changing into another substance by responding. An illustration of a substance property is the capacity of chlorine gas to respond violently when blended in with sodium. The synthetic response makes another substance, sodium chloride (table salt). Actual properties allude to various types of a substance;however, the substance stays as before; no compound response or change to another substance happens.

A portion of the properties that the utilitarian gatherings give incorporate extremity and corrosiveness. For instance, the useful gathering called carboxyl (- COOH) is a frail corrosive. Extremity alludes to one finish of a particle having a charge (polar), and the opposite end having no charge (nonpolar). For instance, the plasma layer has hydrophilic heads outwardly that are polar, and the hydrophobic tails (which are nonpolar) structure within the plasma membrane.

CBSE and ICSE Board Sample Papers from Oswal Publishers. Buy Solomons Organic Chemistry Book Online and books for all subjects Maths, Science, Social and Languages.

0 notes

Text

NCERT Solutions For Class 7 Hindi

Hindi NCERT Solutions for Class 7

Bal Mahabharat Katha, Durva and Vasant are the three works which are a part of CBSE Hindi curriculum. These books are well-designed to be studied by students of class 7th. These books were put together to give students a sample of Hindi literature. One of the three textbooks for Class 7 is NCERT Hindi Mahabharat Katha. Mahabharat is one of two great Hindu epics, the other being the Ramayana and is the longest epic in the world.

Everyone in this country would benefit enormously by reading and understanding these excellent legends and tales. Even today, it continues to inspire people throughout the world. The many characters in the epic may be understood with this textbook. Students will benefit immensely if they read not just from the textbook but also from other reference sources in order to grasp all of the story’s hidden meanings and references.

The second book recommended by the board is NCERT Hindi Vasant for Class 7. This book contains a compilation of essays, tales, and literary works by a number of well-known authors. The chapters in this book will help pupils fall in love with the language as they gradually learn the deeper meanings of each chapter because the chosen narratives not only arouse the students’ curiosity but also encourage them to think and allow their imaginations to run wild, which is the main purpose of any language.

This book has 20 chapters, each one of them equally essential. It is also necessary to ensure that the underlying implications of the chapters are understood. This is when Extramarks NCERT Class 7 Solutions come in handy.

NCERT Solutions for Class 7 Hindi

NCERT Solutions for Class 7 Hindi offer complete and exact answers to all the questions from the textbook Mahabharat. Moreover, on Extramarks website, you can find detailed answers to the questions in the supplementary book Vasant. Our subject-matter experts have diligently created these solutions to provide you with the most standard answers. Students can click the link below and access NCERT Solutions for Class 7 Hindi.

Why is Extramarks the Most Preferred Website?

Extramarks provides free study resources created by subject matter experts for all the students. It also offers outstanding academic assistance to students. Besides this, it provides interactive videos and quizzes to help students to learn these intriguing topics and goes beyond the textbooks. It regularly updates the syllabus, study materials, revision notes, guides, past question papers, etc on the website. Also, NCERT solutions for Class 7 are available on Extramarks. The subject matter experts at Extramarks prepare the solutions for students.

The Hindi syllabus is extensive. Hence, the NCERT Solutions for Class 7 Hindi on Extramarks will help you complete it within the allotted time. The solutions to the NCERT Hindi book for Class 7 allow students to participate, identify difficulties and solve them. The more you practise, the more confidence you get, and the study material properly prepares you ahead of the examination.

This NCERT Solution set on Extramarks focuses not only on the precise understanding of each term, but also assists with module answers in order to prepare students for any tests.

0 notes

Text

Myabhyas - The Art of Learning Smart

youtube

Myabhyas India’s best online learning platform for KSEEB & CBSE. 24/7 Online Solution to all your doubts. Get Live Learning Experience with our Virtual Reality Classroom.

My Abhyas, online training solutions are a great resource to keep them educated. It makes your children's learning process wholesome and holistic. Launched in 2020, My Abhyas offers highly personalized and effective learning programs for classes 1 - 12 (K-12). This app is like a one-stop solution for CBSE, KSEEB students. Whether it comes to homework help, doubt clearing sessions, textbook solutions, video lessons, sample papers, mock tests, easy revision notes for class 6-12, previous year board papers as well.

This online learning platform is very interactive for both the students and tutor, as they are able to see, hear, write and interact in real-time. The app features quiz, quick tests and a facility to clarify doubts. The app provides students a learning platform where they can learn, engage and be excited about charting their own path to discover the world. The platform brings together the best teachers, technology, content, media for creating a seamless, world class learning experience. With NEP 2020 laying the foundation for a New India, preparing students for the future with the knowledge that will be needed for the 21st Century, online learning app like Myabhyas is a boon to your kid…

Our Virtual Reality Features will turn your Normal classroom into something more fantastic and help you the best possible way to boost your Overall growth.

Mission

Discover, share, and implement effective technology- enhanced learning practices that promote active, collaborative, and authentic learning. Create an immersive learning environment for students to develop foundational skills and knowledge for the 21st century workplace. Provide teachers with educational technology, professional development and classroom facilitation.

Vision

Is to take education to the remotest part of India.

Provide the best educational experience to every student.

Keep the costs affordable to everyone.

Structured Courses

Structured courses offered by Myabhyas give out a well-planned flow of content to help make it easier for the user to interact with. It reduces the complexity of concepts by breaking it down into simpler sections, also known as divide and conquer.

Live tests and quizzes:

It helps stimulate a healthy competitive side of your kid which he carries on for a lifetime. Network with the group Eliminating parents biggest fear, the online learning platform provides plenty of learning and networking opportunities.

Contact: www.myabhyas.com

Toll free: 1800 572 4455

0 notes

Video

youtube

same day essay

About me

Different Styles Of Essay Writing

Different Styles Of Essay Writing Be conscious any facts or statistics you’re capable of recall for this kind of essay query and earn a list of contemporary examples from actual life. When you’re typing the essay you want to ensure you double house every line all through the complete essay, for instance, title web page and reference page. If you’re absent, you aren’t going to need to fall behind on homework. You might immediately download the complete syllabus from the given link. A photograph of the complete apparatus needs to be supplied. A good article might recognize that that handbook’s use shall be to get that click on on. As an example you can distribution a analyze on exactly what into pay not as or that the simplest means into make dwelling simpler by performing X Y Z. If a service provides a wholly free trial, pay attention to how a lot it's going to price later so that you may make certain your sales justify the value. Test our services and you will perceive that getting an essay from the reliable composing service may be a real joy. Thus, as a way to achieve success you also should learn to search out an article that has been custom written. Besides this, college students should also repair the previous yr question papers together with the CBSE pattern papers to accumulate a notion about the marking scheme and query pattern. viewing each amongst these elements to thought it's important one could purchase essay lettering service out of online web. Utilizing a specialist service shall be extra certain which the main points has at your private resume. it’s potential to start looking to get services on the internet and options wouldbe gotten by you. essay writing The time period is often subjective. Every post serves like a writing sample to commence utilizing. film titles in a paper If you're curious at our essay please login and place a purchase order if you need to be fresh into our corporations, or register. Essay writing might presumably be a tense task not just for first-year college students but additionally for educated pupils. Each expository essay will most probably have particular goal. Pay for essays on the internet could possibly be the very best possibility for college college students. Immediately following that, you’re prone to at once setup in your own author that's non-public and likewise you can be in touch with him. you can email Primo Essay as utilizing the online steering may be bought across the clock. We are in a position to preferentially fulfill your aim at timeline. Exemple dissertation for different do not use this area. In fact, it is much more advisable to begin with child steps like writing just a few paragraphs every day. Academic papers want you to find out a selected angle to pursue in writing, which goes to be the idea of the paper. In addition, it’s a discrete amount for its components don’t have any frequent boundary. The purpose is to find errors in a program whereas it’s running, instead of by repeatedly examining the code offline. Writers will discover they don't have the power to enhance phrases to create the variant particular although others may don’t repeat the unique’s overall significance or might add extra details. With the various authors available now, you'll be able to access and outsource most your writing wants. Exemple dissertation zahnmedizin marburg zombies dissertation paper modifying services, hyperlink.

0 notes

Text

NCERT Class 12 Macro Economics Chapter 2 National Income and Related Aggregates

NCERT Class 12 Micro Economics Solutions

Chapter-2 National Income and Related Aggregates

NCERT TEXTBOOK QUESTIONS SOLVED:> Q 1. Why should the aggregate final expenditure of an economy be equal to the aggregate factor payments? Explain. [3 Marks]

Ans: The sum of final expenditures in an economy must be equal to the income received by all the factors of production taken together (final spending on final goods, it does not include spending on intermediate goods). This follows from the simple idea that the revenues earned by all the firms put together must be distributed among the factors of production as salaries, wages, profits, interests earning and rents. Q 2. What is the difference between planned and unplanned inventory accumulation? Write down the relation between change in inventories and value added of a firm. [3 Marks]

Ans: Planned Inventory. It refers to changes in the stock inventories that have occurred in a planned way. In a situation of planned inventory accumulation, firm will plan to raise its inventories. Unplanned Inventory. It refers to changes in the stock of inventories that have occurred in an unexpected way. In a situation of unplanned inventory accumulation, due to unexpected fall in sales, the firm will have unsold stock of goods.

Value added of a firm (GVA) = Gross value of output produced by the firm – Value of intermediate goods used by the firm. OR GVA = Value of sales by the firm + Value of change in inventories – Value of intermediate goods used by the firm Q 3. Write down the three identities of calculating the GDP of a country by the three methods. Also, briefly explain why each of these should give us the same value of GDP. [3 Marks]

Ans: National Income = National Product = National Expenditure. Each one will give the same result. The only difference is that with product methods, NI is calculated at production or creation level with income Method NI is measured at distribution level, and with expenditure method NI is measured at disposal level. Q 4. Define budget deficit and trade deficit. The excess of private investment over saving of a country in a particular year was Rs 2,000 crores. The amount of budget deficit was (-) Rs 1,500 crores. What was the volume of trade deficit of that country? [3-4 Marks]

Ans: Budget deficit. It measures the amount by which the government expenditure exceeds the tax revenue earned by it. Budget Deficit = G – T.

Trade deficit: It measures the amount of excess expenditure over the export revenue earned by the country.

Trade Deficit = M – X Given G – T = (-) Rs 1500 crore Investment – Saving = Rs 2000 crore Trade deficit = [I – S] + [G – T] = [2000]+ [-1500] = Rs 500 crore. Q 5. Suppose the GDP at market price of a country in a particular year was Rs 1,100 crores. Net Factor Income from Abroad was Rs 100 crores. The value of Indirect taxes – Subsidies was Rs 150 crores and National Income was Rs 850 crores. Calculate the aggregate value of depreciation. [3 Marks]

Ans: National Income (or NNPFC) = GDPmp- Depreciation + Net factor income from abroad – [Indirect Taxes-Subsides] 850 = 1100 – Depreciation +100- 150 Depreciation = 1100+ 100- 150-850 Depreciation = Rs 200 Crore Q 6. Net National Product at Factor Cost of a particular country in a year is Rs 1,900 crores. There are no interest payments made by the households to the firms / government, or by the firms / government to the households. The Personal Disposable Income of the households is Rs 1,200 crores. The personal income taxes paid by them is Rs 600 crores and the value of retained earnings of the firms and government is valued at Rs 200 crores. What is the value of transfer payments made by the government and firms to the households? [3-4 Marks]

Ans: Personal disposable income = Personal income – Personal tax – miscellaneous receipts of government 1200 = Personal Income – 600 – 0 Personal Income = 1800 Crore Private Income = Personal income + retained earnings + corporate tax = 1800 + 200 + 0 = 2000 Crore Private income = NNPFC (National income) – NDPFC of government sector + Value of transfer payment 2000 = 1900 – 0 + Value of transfer payment Value of transfer payment =100 Crore Q 7. From the following data, calculate Personal Income and Personal Disposable Income. [6 Marks]

Ans: Private Income = NDPFC – NDPFC of government sector + NFIA + Transfer Income + net interest receive from household (Interest Received by Households – Interest Paid by Households) = (i) – 0 + (ii) + (vii) + [(v) – (vi)] = 8000 + 200 + 300 + (1500 – 1200) = 8800 Crore

Personal Income = Private income – Undistributed profit – Corporation tax = 8800 – (iii) – (ii) = 8800 – 1000 – 500 = 7300 Crore Personal Disposable Income = Personal income – Personal tax = 7300 – (viii) = 7300 – 500 = 6800 Crore Q 8. In a single day Raju, the barber, collects Rs 500 from haircuts; over this day, his equipment depreciates in value by Rs 50. Of the remaining Rs 450, Raju pays sales tax worth Rs 30, takes home Rs 200 and retains Rs 220 for improvement and buying of new equipment. He further pays Rs 20 as income tax from his income. Based on this information, complete Raju’s contribution to the following measures of income Gross Domestic Product NNP at market price NNP at factor cost Personal income Personal disposable income. [3-4 Marks] Ans: GDP contribution by Raju = Rs 500 NNPMP (Raju’s contribution) = GDP – Depreciation = 500 – 50 = Rs 450. NNPrr (Raju’s contribution) = NNPMP -Indirect tax =450-30 = Rs 420 Personal Income = NNPFC-Retained Earnings = 420 – 220 = Rs 200 Personal Disposable Income = Personal Income – Income Tax = 200 – 20 = Rs 180 Crore Q 9. The value of the nominal GNP of an economy was Rs 2,500 crores in aparticular year. The value of GNP of that countiy during the same year evaluated at the prices of the same base year was Rs 3,000 crores. Calculate the value of the GNP deflator of the year in percentage terms. Did the price level rise between the base year and the year under consideration? [3-4 Marks]

Ans: GNP deflator = Nominal GNP/Real GNP x 100 = 83.3% No, the price level did not rise between the base year and the year under consideration. In fact, it fell. Q 10. Write down some of the limitations of using GDP as an index of welfare of a : countiy. [6 Marks] OR Explain how distribution of gross domestic product is its limitation as a measure of economic welfare. [CBSE Delhi 2010] OR Explain how ‘distribution of gross domestic product’ is a limitation in taking domestic product as an index of welfare. [CBSE Delhi 2011]OR Can gross domestic product be used as an index of welfare of the people? Give two reasons. [CBSE Foreign 2010] OR Explain Per Capita Real GDP as Indicator of Economic Welfare. OR Explain any four limitations of using GDP as a measure/index of welfare of a country. [CBSE Sample Paper 2016]

Ans: Per Capita Real GDP can be taken as indicator for economy. But by itself is not an adequate indicator. There are many reasons behind this. These are: Many goods and services contributing economic welfare are not included in GDP Or Non-Monetary exchanges.

(a) There are many goods and services which are left out of estimation of national income on account of practical estimation difficulties e.g., services of housewives and other members, own account production, etc.

(b) These are left on account of non availability of data and problem in valuation.

(c) It is generally agreed that these items contribute to economic welfare.

(d) So, if we depend only on GDP, we would be underestimating economic welfare.

Though externalities are not taken into account in GDP, they affect welfare.

(a) When the activities of somebody result in benefits or harms to others with no payment received for the benefit and no payment made for the harm done, such benefits and harms are called externalities.

(b) Activities resulting in benefits to others are positive externalities and increase welfare; and those resulting in harm to others are called negative externalities, and thus decrease welfare.

(c) GDP does not take into account these externalities.

(d) For example, construction of a flyover or a highway reduces transport cost and journey time of its users who have not contributed anything towards its cost. Expenditure on construction is included in GDP but not the positive externalities flowing from it. GDP and positive externalities both increase welfare. Therefore, taking only GDP as an index of welfare understates welfare. It means that welfare is much more than it is indicated by GDP.

(e) Similarly, GDP also does not take into account negative externalities. For examples, factories produce goods but at the same time create pollution of water and air. River Yamuna, now a drain, is a living example. The pollution harms people. The factories are not required to pay anything for harming people. Producing goods increases welfare but creating pollution reduces welfare. Therefore, taking only GDP as an index of welfare overstates welfare In this case, welfare is much less than indicated by GDP.

Change in the distribution of income (GDP) may affect welfare. (a) All people do not earn the same amount of income. Some earn more and some earn less. In other words, there is unequal distribution of income.

(b) At the same time, it is also true that in the event of rise in ‘per capita real income’ all are not better off equally. ‘Per capita’ is only an average. Income of some may rise by less and of some by more than the national average. In case of some it may even fall.

(c) It means that the inequality in the distribution of income may increase or decrease.

(d) If it increase it implies that rich become more rich and the poor become more poor.

(e) Utility of a rupee of income to the poor is more than to the rich. Suppose, the income of the poor declines by one rupee and that of the rich increases by one rupee. In such a case, the decline in welfare of the poor will be more than the increase in welfare of the rich.

(f) Therefore, if the rise in per capita real income inequality increases, it may lead to a decline in welfare (in the macro sense).

All products may not contribute equally to economic welfare. (a) GDP includes different types of products, like food articles, houses, clothes, police services, military services, etc. (b) Some of these products contribute more to the welfare of the people, like food, clothes, houses, etc. Other products like police services, military services etc. may comparatively contribute less and may not directly affect the standard of living of the people. (c) Therefore, how much is the economic welfare would depend more on. the types of goods and services produced, and not simply how much is produced. (d) It means that if GDP rises, the increase in welfare may not be in the same proportion.

Contribution of some products may be negative (a) GDP includes all final products whether it is milk or liquor. (b) Milk may provide both immediate and ultimate satisfaction to consumers On the other hand, liquor may provide some immediate satisfaction, but because of its harmful effects on health it may lead to decline in welfare. (c) GDP include only the monetary values of the products and not their contribution to welfare. (d) Therefore, economic welfare depends not only on the volume of consumption but also on the type or goods and services consumed.

I. VERY SHORT ANSWER TYPE QUESTIONS (1 Mark)

Q 1. Define ‘depreciation’. [CBSE (Al) 2011]

Ans: Depreciation is an expected decrease in the value of fixed capital assets due to its general use. Q 2. When is the net domestic product at market price less than the net domestic product at factor cost?

Ans: When net indirect taxes are negative i.e., subsidies are more than indirect taxes. Q 3. Why is gross domestic product at factor cost more than the net domestic product at factor cost?

Ans: Gross domestic product at factor cost includes depreciation while net domestic product at factor cost does not include depreciation. Q 4. When will GDP of an economy be equal to GNP?

Ans: GDP and GNP will be equal when the ‘net factor income from abroad’ is zero. Q 5. When will the domestic income exceed the national income?

Ans: When the net factor income from abroad is negative. Q 6. If NDPFC is Rs 1,0000 crores and NFIA is (-) Rs 500 crores, how much will be the national income?

Ans: National Income = 10000 + (-500) = Rs 9500 Crore Q 7. If the domestic factor income is Rs 50,000 crores and the national income is Rs 45,000 crores, how much will be the net factor income from abroad?

Ans: Net factor income from abroad = 45,000 – 50,000 = (-) Rs 5000 Crore Q 8. Mention the three methods of measuring national income.

Ans: Value added method Income method Expenditure method. Q 9. Calculate the disposable income, if personal income is Rs 30,000 and the rate of income tax is 10%.

Ans: Disposable Income = 30,000 – (10% of 30,000) = ?27,000 Q 10. In which type of economy, domestic income will be equal to national income?

Ans: Closed economy. Q 11. What is the value added method of measuring national income?

Ans: Value added method is the method that measures the national income by estimating the value added by each producing enterprises within the domestic territory of the country in an accounting year. Q 12. When is value of output equal to value added?

Ans: Value of output is equal to value added if there are no intermediate costs. Q 13. What aggregate do we get when we add up the gross value added of all the producing sectors of an economy?

Ans: Gross domestic product at market price. Q 14. What is the rationale for not taking into account the value of intermediate goods in the measure of GDP?

Ans: To avoid the problem of double counting. Q 15. If compensation of employees in a firm constitutes 65% of net value added at factor cost of a firm, find the proportion of operating surplus.

Ans: 100% – 65% = 35% (assuming mixed income is zero). Q 16. What is nominal gross domestic product? [CBSE Delhi 2011]

Ans: When gross domestic product (GDP) of a given year is estimated on the basis of price of the same year, it is called nominal GDP. Q 17. Define primary sector.[CBSE AI2013,]

Ans: It is the sector that produces goods by exploiting natural resources like land, water, forests, mines, etc. This sector includes agricultural and allied activities, fishing, mining and quarrying. Q 18. Define secondary sector.

Ans: It is called manufacturing sector also. Enterprises in this sector transform one type of commodity into another type of commodity. For example: leather goods from leather, flour from wheat, sugar from sugarcane, etc. Q 19. Define tertiary sector.

Ans: It is known as service sector also. Enterprises in this sector produce services only. Examples are banking, transport, communications etc. II.MULTIPLE CHOICE QUESTIONS (1 Mark)

Q 1. Which one of the following statements is incorrect? (a) GDP at market price = GDP at factor cost plus net indirect taxes. (b) NNP at factor cost = NNP at market price minus indirect taxes. (c) GNP at market price = GDP at market price plus net factor income from abroad. (d) None of them.

Ans: (a) Q 2. National income differs from net national product at market price by the amount———–. (a) current transfers from the rest of the world (b) net indirect taxes (c) national debt interest (d) it does not differ

Ans: (b) Q 3. Net national product at factor cost is————-. (a) equal to national income (b) less than national income (c) more than national income (d) sometimes less than national income and sometimes more than it

Ans: (a) Q 4. The net values added method of measuring national income is also known as—————-. (a) net output method (b) production method (c) industry of origin method (d) all of the above

Ans: (d) Q 5. Identify the item which is not a factor payment: (a) Free uniforms to defense personnel (b) Salaries to the members of Parliament (c) Imputed rent of an owner occupied a building . (d) Scholarships given to the students of scheduled caste

Ans: (d) Q 6. Mixed income of the self-employed means (a) gross profits received by proprietors (b) rent, interest and profit of an enterprise (c) combined factor payments which are not distinguishable (d) wages due to family workers

Ans: (c) Q 7. Demand for final consumption arises in ——————-. (a) household sector only (b) government sector only (c) both household and government sectors (d) neither in households nor in government sector

Ans: (c) Q 8. Demand for intermediate consumption arises in—————— . (a) consumer households (b) government enterprises only (c) corporate enterprises only (d) all producing sectors of an economy

Ans: (d) Q 9. Which one of the following options is an economic activity? (a) Listening to music on the radio. (b) Teaching one’s own son at home. (c) Medical facilities rendered by a charitable dispensary. (d) A housewife doing household duties.

Ans: (c) Q 10. Net value added is equal to—————– . (a) payments accruing to factors of production (b) compensation to employees (c) wages plus rents (d) value of output minus depreciation

Ans: (a) Q 11. Per capita national income means: (a) NNP/population (b) Total capital population (c) Population NNP (d) None of them

Ans: (a) Q 12. Which one of the following statements is correct? (a) If national income rises, per capita income must also rise (b) If population rises, per capita income must fall. (c) If national income rises, welfare of the people must rise. (d) None of them

Ans: (d) III. SHORT ANSWER TYPE QUESTIONS (3-4 Marks)

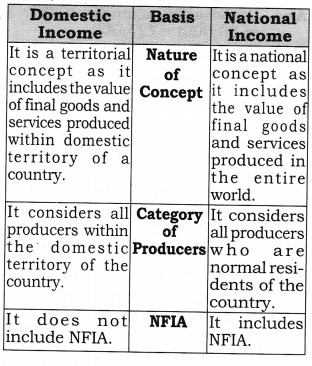

1. Distinguish between domestic product and national product. When can domestic product be more than national product? [CBSE (Al) 2009] OR Differentiate between Domestic Income (NDPFC) Vs National Income (NNPFC).

Ans:

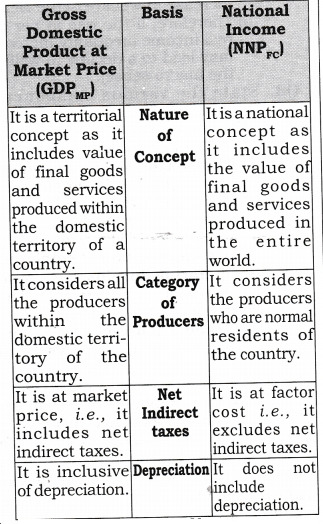

Domestic product will be greater than national product when net factor income from abroad is negative. Q 2. Differentiate between Gross Domestic Product at Market Price Vs National Income.

Ans:

Q 3. Differentiate between National Income at constant price and national income at current price?

Ans:

Q 4. Distinguish between real and nominal gross domestic product.[CBSE(AI) 2010] Or Discuss any two differences between GDP at constant prices and GDP at current Prices.[CBSE Sample Paper 2016]

Ans:

Q 5. Explain how ‘externalities’ are a limitation of taking gross domestic product as an index of welfare. [CBSE Foreign 2011]

Ans: When the activities of somebody result in benefits or harms to others with no payment received for the benefit and no payment made for the harm done, such benefits and harms are called externalities.

Activities resulting in benefits to others are positive externalities and increase welfare; and those resulting in harm to others are called negative externalities, and thus decrease welfare.

GDP does not take into account these externalities.

For example, construction of a flyover or a highway reduces transport cost and journey time of its users who have not contributed anything towards its cost. Expenditure on construction is included in GDP but not the positive externalities flowing from it. GDP and positive externalities both increase welfare.

Therefore, taking only GDP as an index of welfare understates welfare. It means that welfare is much more than it is indicated by GDP.

Similarly, GDP also does not take into account negative externalities. For examples, factories produce goods but at the same time create pollution of water and air. River Yamuna, now a drain, is a living example. The pollution harms people. The factories are not required to pay anything for harming people. Producing goods increases welfare but creating pollution reduces welfare. Therefore, taking only GDP as an index of welfare overstates welfare. In this case, welfare is much less than indicated by GDP. Q 6. Explain how “Non-Monetaiy exchanges’ are a limitation in taking gross domestic product as an index of welfare.[CBSE(AI) 2011]

Ans: There are many goods and services which are left out of estimation of national income on account of practical estimation difficulties e.g., services of housewives and other members, own account production, etc. These are left on account of non¬’ availability of data and problem in valuation. It is generally agreed that these items contribute to economic welfare. So, if we depend only on GDP, we would be underestimating economic welfare. Q 7. Explain how distribution of ‘Gross Domestic Product’ is a limitation in taking gross domestic product as an index of welfare.[CBSE Delhi 2010, 2011]

Ans: All people do not earn the same amount of income. Some earn more and some earn less. In other words, there is unequal distribution of income.

At the same time, it is also true that in the event of rise in ‘per capita real income’ all are not better off equally. ‘Per capita’ is only an average. Income of some may rise by less and of some by more than the national average. In case of some it may even fall.

It means that the inequality in the distribution of income may increase or decrease.

If it increase it implies that rich become more rich and the poor become more poor.

Utility of a rupee of income to the poor is more than to the rich. Suppose, the income of the poor declines by one rupee and that of the rich increases by one rupee. In such a case, the decline in welfare of the poor will be more than the increase in welfare of the rich.

Therefore, if the rise in per capita real income inequality increases, it may lead to a decline in welfare (in the macro sense). Q 8. State the various components of the income method that are used to calculate national income.[CBSE Sample Paper 2014]

Ans: Compensation of employees: The amount earned by employees from their employer, whether in cash or in kind or through any other social security scheme is known as compensation of employees. Operating Surplus: It is the sum of income from property and income from entrepreneurship. Mixed Income: Income of own account workers (like farmers, doctors, barbers, etc.) and unincorporated enterprises (like small shopkeepers, repair shops) is known as mixed income.

Note: (i) To estimate amount of factor payments made by each producing unit. (ii) To add all factor incomes/payments within domestic territory to get domestic income, i.e., NDPFC. NDPFC = Compensation of employees + Operating Surplus + Mixed Income Net factor income from Abroad(NFIA): NFIA is the difference between income earned by normal residents from rest of the world and similar payments made to Non residents within the domestic territory. Addition of NFIA to NDPFC to get NY, i.e., NNPpc. NNPFC = NDPFC + NFIA Q 9. Define double counting. How can the problem of double counting be avoided?

Ans: If a single transaction is recorded twice or more than twice in the calculation of national income, then it is known as double counting.

The problem of double counting is solved by value added method. Theoretically to avoid double counting there may be two alternative ways:

Final Product Approach (Value Added Approach)

Final Product Approach: According to this, value of only final products, i.e. which go for final consumption or capital formation should be included. But in practical application of this approach double counting still creeps in as every producer treats the product he sells as final whereas the same might have been used as intermediate product by the buyer.

Value Added Approach: Value added method is most effective in avoiding double counting. According to this, instead of taking value of final goods, only value added at each stage of production by a producing unit is taken. Value added of a firm by subtracting intermediate consumption from value of output. IV. TRUE OR FALSE Giving reasons, state whether the following statements are true or false.

Q 1. In a closed economy, gross national product is always equal to gross domestic product.

Ans: True: When net factor income from abroad is zero i.e., income from abroad is equal to income to abroad. Q 2. Gross investment can be equal to net investment.

Ans: True: It is possible when depreciation is zero. Q 3. Domestic Income of a country can be more than its National income.

Ans: True: It can happen when NFIA is negative i.e., factor income paid to abroad is more than factor income received from abroad. Q 4. Market price is always more than factor cost.

Ans: False: Market price can be less than factor cost if net indirect taxes (NIT) are negative. Market price can also be equal to factor cost if NIT is zero. Q 5. Measurement of national income at current prices provides a reliable base of comparison.

Ans: False: National Income at ‘Constant Prices’ provides a reliable base of comparison. Q 6. Nominal GDP can never be less than Real GDP.[CBSE Sample Paper 2010]

Ans: False: Nominal GDP can be less than real GDP, if prices in the current year are less than the prices in the base year. Q 7. Net capital gains from the sale of property is a part of domestic factor income.

Ans: False: It is not a part of domestic factor income. It is. a sale of property and not of factors. Q 8. Change in stock is not a part of Capital formation.

Ans: False: Change in stock is a part of domestic capital formation. Q 9. Brokerage paid on sale of shares and income from shares purchased is not a part of national income.

Ans: False: Brokerage paid on sale of shares or any other item is a part of national income. Q 10. Salary of Pakistan worker, working in Indian Embassy is not a national income of India.

Ans: True: It is an expenditure made by- Indian Embassy. It is a part of Indian domestic income. Q 11. Income tax paid is not a part of national income.

Ans: False: Income tax paid is part of national income. It is included in profit and individual income. Q 12. Income from imputed rent of self- occupied houses is a part of national income.

Ans: True: It is an estimated amount of . rent. If rented to any other person, he would receive the amount of rent. Q 13. Net profit of any Bank of India’s branch in USA will not be included in Indian National income.

Ans: False: Net profit of any Bank of India at USA branch is a part of national income of India. Q 14. Exports do not form a part of domestic factor income.

Ans: False: Exports are made from domestic production. It is a part of domestic factor income. Q 15. Gross domestic product at market price includes net factor income from abroad and net indirect taxes.

Ans: False: GDPMP does not include net factor income from abroad but includes net indirect taxes. Q 16. Gross National Product is always less than Gross National expenditure.

Ans: False: Gross national product is always equal to gross national expenditure. Q 17. Exports are a part of net factor income from abroad.

Ans: False: Exports are a part of domestic income. Exports are sent from home production. Q 18. Real GDP includes domestic income at current prices.

Ans: False: Real GDP is taken at some constant prices. It does not have the influence of price fluctuations. Q 19. National disposable income includes current transfers income of government.

Ans: False: National income includes income of government sector in the form of receiving of taxes. Q 20. Private income does not include net factor income from abroad.

Ans: False: Private income is a national concept. It also includes net factor income from abroad. Q 21. Personal income does not include income from personal taxes.

Ans: False: Personal income includes personal taxes, but not corporate taxes. Q 22. Personal disposable income is equal to aggregate consumption and savings.

Ans: True: Personal disposable income can be disposed upon consumption and savings both. Q 23. Private income includes earned incomes of private sector from all sources.

Ans: False: Private income includes both earned income (factor income) as well as unearned income (transfer income) of private sector from all sources. Q 24. National disposable income is the disposable income of private sector.

Ans: False: It is the disposable income of the whole country (public sector and private sector). Q 25. Travelling allowance paid by employer is a part of national income.

Ans: False: Travelling allowances are paid by an employee and then recovered from employer. It is not a part of national income Q 26. Consumption of food grains by farmer himself is not a part of national output.

Ans: False: It is a part of domestic output. It is a part of national income. Q 27. Sale of second hand car is not included in national income.

Ans: True: It’s original sale has already been included in national income of previous year. If done it will be case of double counting. Q 28. Rent received by an American from Reliance Industries with respect to building located in India will neither be included in national income nor in domestic income of India.

Ans: False: Such rent will be included in domestic income of India as building is located within the domestic territory of India Q 29. Purchase of car by a consumer is a part of gross domestic capital formation.

Ans: False: It is a part of private final consumption expenditure. Q 30. Goods produced for self-consumption will be included in national income.

Ans: True: Such goods contribute to the current output and their imputed value will be included in national income. Q 31. Gross domestic capital formation is always greater than gross fixed capital formation. [CBSE Sample Paper 2010]

Ans: False: Gross domestic capital formation can be less than gross fixed capital formation if change in stock is negative. Note: As per CBSE guidelines, no marks will be given if reason to the answer is not explained. V. LONG ANSWER TYPE QUESTIONS(6 Marks)

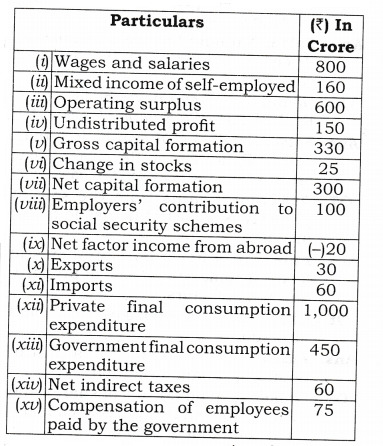

Q 1. Calculate GNP at FC from the following data by income method, and expenditure method. [CBSE 2002]

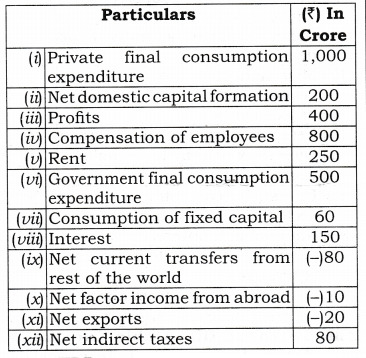

Ans: NDPFC = Compensation of employees (Wages and salaries + Employer’s contribution towards social security scheme) + Operating Surplus + Mixed Income = [(i) + (viii)] + (iii) + (ii) = [800 + 100] + 600 + 160 = 900 + 600 + 160 = 1660 Crore GNPFC = NDPFC + Depriciation (Gross capital formation – Net capital Formation) + Net Factor Income from abroad = 1660 + [(H) – (nil) + (6c)] = 1660 + [330-300] + (-20)] = 1660 + 30 – 20 = 1670 Crore GDPMP = Government final consumption expenditure (Public final consumption expenditure) + Private final consumption expenditure + Gross domestic Capital formation + Net export (Export – Import) = (xiii) + (xii) + (v) + [(x) – (xi)] = 450 + 1000 + 330 + [30 – 60] = 1750 Crore . GNPFC = GDPMP + Net factor income from abroad – Net Indirect Tax = 1750 + (be) – (xiv) = 1750 + (- 20) – 60 = 1750 – 20 – 60 = 1670 Crore Q 2. Calculate “Gross National Product at Factor Cost” from the following data by (a) Income method, and (b) Expenditure method:[CBSE 2009]

Ans: NDPFC = Compensation of Employees + Operating Surplus( profit + Rent + Interest + Mixed Income = (iv) +[(iii) + (v) + (viii)] + 0 = 800 + [400 + 250 + 150] = 800 + 800 = 1600 Crore GNPFC = NDPFC + Depreciation (Consumption of fixed Capital) + Net factor Income from abroad = 1600 + (vii) + (x) = 1600 + 60 + (-10) = 1650 Crore GDPMP = Government final consumption expenditure + Private final consumption expenditure + Gross domestic capital formation (Net domestic capital formation + consumption of fixed capital) + Net export = (x) + (i) + [(ii) + (vii)] + (xi) = 500 + 1000 + [200 + 60] + (- 20) = 500 + 1000 + 260 – 20 = 1740 Crore GNPFC = GDPMP + Net factor income from abroad – Net Indirect Tax = 1740 + (x) – (xii) = 1740 + (-10] – 80 = 1650 Crore Q 3. From the following data, calculate (a) Gross Domestic Product at Factor Cost and (b) Factor Income To Abroad:[CBSE 2010]

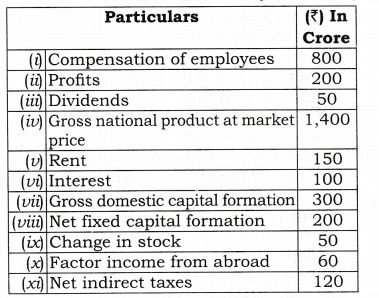

Ans: (a) NDPFC = Compensation of employees + Operating surplus (Profit + Rent + Interest) + Mixed income = (i) + P) + (v) + M] + 0 = 800 + [200 + 150 + 100] = 800 + 450 = 1250 Crore Note: Gross domestic capital formation = Net fixed capital formation + Depreciation + Change in stock (vii) = (viii) + Depreciation + (ix) 300 = 200 + Depreciation + 50 Depreciation = 300 – 250 = 50 GDPFC = NDPFC + Depriciation = 1250 + 50 = 1300 Crore (b) GNPMP = GDPFC + NFIA (Factor income from abroad – Factor income paid to abroad) + Net indirect tax (iv) = 1300 + [(x) – Factor income paid to abroad] + (xi) 1400 = 1300 + (60 – Factor income paid to abroad) + 120 1400 = 1480 – Factor income paid to abroad Factor income paid to abroad = 1480 – 1400 = 80 Crore Q 4. Calculate (a) Private Income and (b) Gross Domestic Product at Factor Cost: [CBSE 2013, C, Set-I] Ans: Personal Disposable Income = Personal income – Direct taxes paid by households – Miscellaneous receipts of government (xi) = Personal Income – (iv) – (i) 200 = Personal income – 30 – 5 Personal Income = 235 Arab Private Income = Personal Income + Retained profits (Savings of private corporate sector) + Corporate Tax = 235 + (iii) + (ii) = 235 + 10 + 20 = 265 Arab „ Private income = NNPFC – Income from Domestic Product Accruing to Public Sector (Income from Property and Entrepreneurship accruing to government Administrative Departments + Saving of Non Departmental Enterprises) + National Debt interest + Current transfers from Government + Net Current transfers from rest of the world , 265 = NNPFC – [(x) + (ii)] + (viii) + (ix) + (vii) ] 265 = NNPFC – (12 + 3) + 15 + 8 + 4 NNPFC = 265 + 15 – 27 = 253 Arab GDPFC = NNPFC + Consumption of fixed capital – Net factor income from abroad = 253 + (xii) – [-(v)] = 253 + 11 + 6 = 270 Arab Q 5. Calculate (a) Private Income and (b) National Income: Ans: Personal Disposable Income =Personal Income – Direct Taxes paid by households – Miscellaneous receipts of Government (i) = Personal Income -(v)- (iii) 120 = Personal income – 15 – 4 Personal Income =139 Arab (Billion) Private Income = Personal Income + Undistributed profits of private sector + Corporate Tax = 139 + (vii) + (vi) = 139 + 3 + 6 = 148 Arab Private income = NNPFC – Income from Domestic Product Accruing to Public Sector (Income from Property and Entrepreneurship accruing to Government Administrative Departments + Saving of Non-Departmental Enterprises) + National Debt interest + Current transfers from government + Net Current transfers from rest of the world 148 = NNPFC – [(ii) + (ix)] + (viii) + (xi) + (iv) , 148 = NNPFC-(5+ 15) + 16 + 2+ 10 NNPFC = 148 + 20 – 28 = 140 Arab Q 6. Find out Gross National Product at Market price and Net National Disposable Income from the following:

Ans: GDPMP = Government final consumption expenditure+Private final consumption expenditure + Gross domestic Capital formation (Net domestic Fixed capital formation + consumption of fixed capital + Change in stocks (closing stock – opening Stock) + Net Export = (vi) + (ii) + {(ix) + (vii) + [(iv) – (i)]} + (-viii) = 300+ 1000+ {150+ 30 + [40-50]}+ (-20) = 300 + 1000 + 170 – 20 = 1450 Arab GNPMP = GDPMP + Net factor income from abroad = 1450 + (-v) = 1450 +[- (-10)] = 1460 Arab NNPFC = GNPMP – consumption of fixed capital – net indirect tax = 1460 – (vii) – 0 = 1460 – 30 = 1430 Arab NNDI = NNPFC + NIT + Net current transfer from rest of the world (abroad) = 1430 + 0 + (-iii) = 1430 + (-5) = 1425 Arab VI. HIGHER ORDER THINKING SKILLS

Q 1. Explain the components of NFIA.[3-4 Marks]

Ans: There are three components of NFIA. Net Compensation of Employees: The net compensation of employees receivable from the rest of the world is equal to the difference between compensation of employees received by resident workers who are living temporarily abroad or are employed abroad , and similar payments made to non- residents workers that are temporarily staying or are employed within the domestic territory of the country.

Met Income From Property and Entrepreneurship: Net income from property and entrepreneurship is equal to the difference between the income received by way of interest, rent and profits by the residents of a country and similar payments made to the rest of the world.

Net Retained Earnings of Resident Companies Abroad: Retained earnings refers to the undistributed profits of the companies. Resident companiesft.e. companies belonging to one country and working in the domestic territory of some other country) retain a part of their profits for further investment abroad. Likewise, foreign companies and their branches retain a part of their profits in the countries of their operation. The difference between the retained earnings of resident companies located abroad and retained earnings of the foreign companies located in a country is equal to the net retained earnings from abroad.

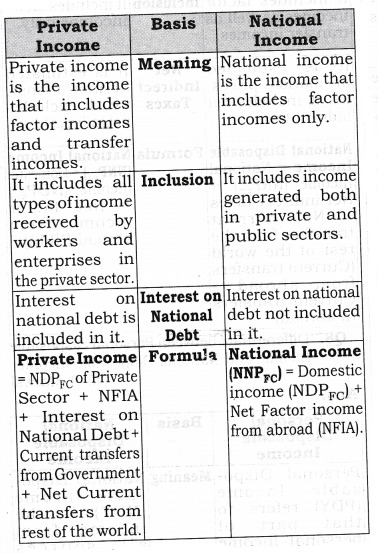

Note: It must be noted that NFIA is zero in a closed economy as such economy does not deal with the rest of the world sector. Q 2. Differentiate between National income and Private income. [3-4 Marks]

Ans:

VII. VALUE BASED QUESTIONS

Q 1. Why do non market economic activities, like Services of housewives Voluntary services and Leisure time activities help in the flow of goods and services of a country. But why are these not included in the estimation of national income? [ 1 Mark] Ans: They are not included in national income, because of non-availability of data and problem in measuring the proper monetary values of these services. Value : Implication of knowledge. Q 2. The given set of prices which is used for finding out real per capita income, should change frequently. Why? [ 1 Mark]

Ans: If the given set of prices used for assessing real per capita income changes frequently, then virtually what we get is nominal per capita income and this defeats the purpose of using or calculating the real per capita income. Value : Critical thinking Q 3. Why comparing the GDPs of various nations might not tell you which nation is better off? [ 1 Mark]

Ans: The well being of nation or standard of living of people is measured by per capita income (GDP / Total Population) and distribution pattern of income not only by GDP. Value : Critical thinking Q 4. GDP Calculation do not directly include the social costs of environmental damages, for example, global warming, acid rain. Do you think these costs should be included in GDP? Why or Why not? [ 1 Mark]

Ans:Yes, because people’s well-being is affected by these environmental damages. No, it is very difficult to assess real damages in monetary terms. Value : Awareness about social cost of GDP. Q 5. GDP growth rate in India for the last few years is more than 6% but still more than 28% of population is lying below poverty line. Explain any two factors responsible for it. [ 1 Mark]

Ans: There are two factors, Unequal distribution of GDP Rise in price level Value : Social awareness Q 6. Should we take real per capita income as an index of economic welfare? If not, why? [1 Mark]

Ans: Real per capita income cannot be taken as an index of economic welfare because there are many items and transactions relating to national income that have no connection with real GDP such as production of defence goods. Also it does not take into account any transaction related to illegal activities, black money and production of services for self-consumption. Value : Critical thinking Q 7. Rakesh pays Rs 1,000 towards premium on his full life policy with the LIC. Is this a part of compensation of employees? [1 Mark]

Ans: No, any contribution made by an employee himself to any insurance scheme is not a part of compensation to employee. Value: Analytic Q 8. How will you treat Rs 20,000 earned per month by Mr Rajesh against hiring out his bus to a neighboring school?[1 Mark]

Ans: Income earned by way of lease is rental income, and hence form part of operating surplus and is included in national income. Value: Analytic

via Blogger https://ift.tt/3kYhwU6

0 notes

Text

CBSE Class 10 Study Material Pdf

Central Board Of Secondary Education (CBSE) is the major preferable education board in India while it is familiar with offering a better education plan in the nation and overseas. Class 10 is deemed as part of the best important levels in a student’s scholarly life. The students address through a bunch of stress and pressure owing to the enormous syllabus and the Board Exams for the initially. Getting a higher percentage for 10th CBSE exams is a significant challenge and spots a move pebble over a better future. You can download CBSE Class 10 Study Material Pdf to prepare well for examination and scores a good percentage.

Students are recommended to figure out the CBSE Class 10 Study Material Pdf files given as under. They will give you an outline of the board exams paper design, kinds of questions interrogated in the exam. Besides, labeling design would assist your child's student in getting ready the subjects early which retains the supreme focus value mostly questions and markings.

Don't be worry we are here to mitigate your stress by offering various educational materials such as Class Notes, Exercise Papers, Referral Matter, Sample Papers, etc. for all the most subjects of Class X CBSE such as English, Hindi, Maths, Science, Social Science, Sanskrit, Computer Science, and Vocational. Video linking is additionally given to give the students an optical awareness of the several chapters.

Importance of CBSE Class 10 Study Material Pdf & Marking Scheme

Per year CBSE launched sample papers for the 10th class board students. Study Material and Marking Scheme has a bunch of advantages various of them are split under as:

Enhance Speed and Time Analysis – Solving numerous sample papers aids the students in testing the time taken by the student on each question. That aids the students in context the time edge as per the kind of question. Handling time performs an important role as a student can finish the exam simply when he/she controls the time consequently.

Raise Confidence – Large ratio of students show up in the board exams facing the absence of reliance or exam worry. If you besides meet the same, then addressing the CBSE issued sample paper is essential and productive. It provides the students with a comfort zone in them. Endless addressing these papers assist in unfreezing the exam anxiety.

Exam Paper Summary – Study Material and Marking Scheme are examined as the top of the best fellow in exam formulation.

It provides an entire summary over kinds of questions wondered in the exam, which matter has a better focus of marks. Aware of the labeling scheme together with the questions are emerging to assist for the tests in getting ready for the exam.Assist in Revision – Wrapping up the syllabus opportune is ourselves the main challenge in board exams. Students who veiled the complete syllabus require to figure out sample papers as it assists in the overhaul together with the self discussion of the efficiency and the existing presently position of student preparation.

Source URL : https://uberant.com/article/801658--cbse-class-10-study-material-pdf/

0 notes

Text

CBSE Class 10 Sample Paper 2025 English Language & Literature

Together with CBSE Sample Paper for Class 10 2025 English Language & Literature (Physical + Digital) for board exams 2025. Multiple QR Codes are provided IN Class 10th CBSE Board Sample Paper English Language & Literature each sample paper that comprises access to solution, e-sample papers, revision notes and much more.

#CBSE Sample Paper for Class 10#CBSE Class 10 Sample Paper 2025#2025 English Language & Literature#Class 10th CBSE Board Sample Paper English Language#Class 10 Sample Paper 2025 English Language & Literature#Together with CBSE Sample Paper for Class 10 2025 English

0 notes